For any private practice owner, understanding your financial health isn't just about knowing how much money is coming in; it's about seeing the whole picture. That comprehensive snapshot is precisely what a Profit and Loss (P&L) statement provides. It reveals if your hard work is truly translating into sustainable profit after all expenses are accounted for. So, a critical question for many SimplePractice users is: can this powerful platform generate a full P&L statement?

The short answer is nuanced: SimplePractice excels at tracking your income and related metrics, providing the vital revenue side of your P&L. While it doesn't automatically compile every single operating expense (like rent or utilities) into a single, comprehensive P&L document within the platform, it offers robust reporting features that give you all the necessary data to construct one. Think of it as providing the essential building blocks, ready for you to assemble into a complete financial masterpiece.

The Heart of Financial Health: Why Your Practice Needs a P&L

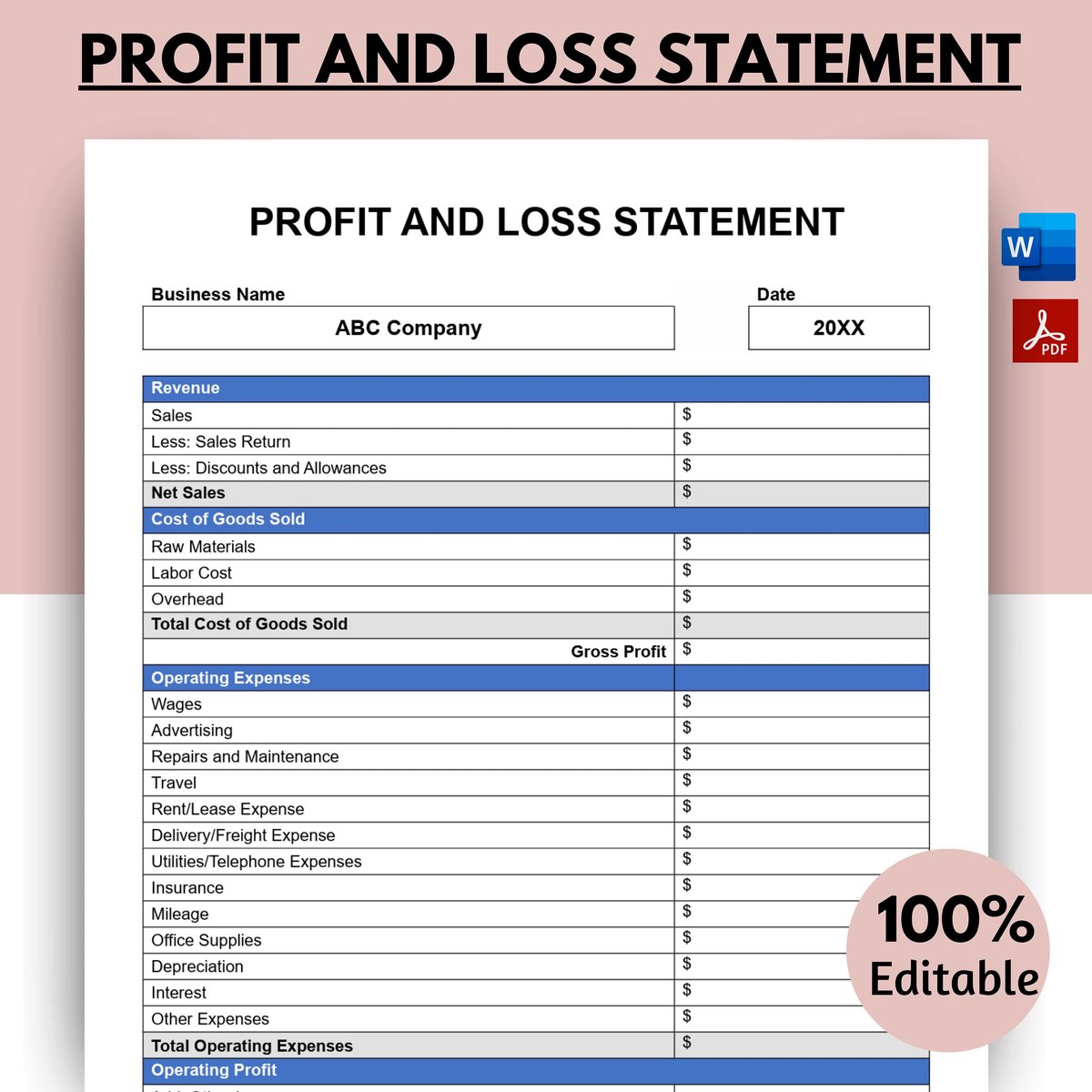

An Income Statement, universally known as a Profit and Loss (P&L) statement, is more than just a financial document; it's your practice's report card. It outlines your financial performance over a specific period by detailing revenues, expenses, and ultimately, your net profit or loss. For a bustling private practice, this statement is indispensable.

Why is it so crucial? A P&L helps you track performance trends, make informed financial decisions, and even secure loans or attract investors. It's fundamental for tax compliance, identifying growth opportunities, and evaluating the effectiveness of your business strategies. Imagine trying to navigate a ship without a compass – that's what running a practice without understanding your P&L can feel like. Key components usually include total revenue, direct costs (if applicable), all operating expenses like salaries, rent, and marketing, and finally, your net income.

SimplePractice's Powerful Financial Reporting Features

SimplePractice is designed to streamline your practice management, and its financial reporting capabilities are a cornerstone of that mission. While it focuses heavily on the income side, these reports are incredibly valuable for understanding where your money comes from and how it moves through your practice.

You'll find several essential reports under the Analytics Reports tab. These include:

- Income Allocation: Perfect for multi-clinician practices on the Plus plan, showing total payments received per clinician within a pay period.

- Income Report: A comprehensive view of monthly total income, detailing client payments, insurance payments, gross income, credit card fees, and your resulting net income. This report is particularly useful for exporting end-of-year totals, providing a clear picture of your revenue streams and direct costs of processing payments.

- Referral Income: Uncover the value of your referral sources, detailing the Total Revenue attributed to them and helping you focus your marketing efforts.

- Payouts: Keep a close eye on all funds issued through your account, including status, bank details, initiation dates, and estimated arrival times.

These reports serve as the foundation of your financial understanding within SimplePractice. To dive deeper into how each of these reports can benefit your practice, and to truly Understand SimplePractices reporting features, exploring the nuances of each one is an excellent next step.

Bridging the Gap: From SimplePractice Data to a Full P&L Statement

While SimplePractice expertly handles your income data, creating a full P&L statement requires integrating this revenue information with all your practice's operating expenses. This means factoring in everything from office rent and utilities to marketing costs, software subscriptions, and administrative salaries – elements that typically aren't tracked directly within SimplePractice's billing system.

The beauty is that SimplePractice makes it easy to export your critical income data, often as CSV or Excel files. This allows you to combine your revenue figures with your independently tracked expenses in a spreadsheet or dedicated accounting software. This combination then allows you to build a complete P&L statement, providing the ultimate overview of your financial performance. For a practical walkthrough, you’ll find immense value in our Step-by-Step Guide to Generating a full profit and loss report, leveraging your SimplePractice data.

Once you have your compiled P&L, the real work of financial management begins: analysis. Understanding what the numbers mean – your gross margin, operating margin, and net profit margin – can highlight areas for improvement, cost savings, and growth opportunities. It's about spotting trends, identifying inefficiencies, and setting realistic financial goals. If you're ready to truly master your practice's financial health, it’s time to Demystify Your Practices P&L with expert insights and analysis strategies.

Beyond Basic Reporting: Enhancing Financial Tracking with Integrations and Export Options

To get the most comprehensive financial picture for your private practice, leveraging SimplePractice's export capabilities with other financial tools is key. Think of your SimplePractice reports as the perfect, organized revenue stream. By exporting this data, you can seamlessly integrate it into accounting software like QuickBooks or Xero, or even a detailed custom spreadsheet. This integration allows you to categorize all your expenses alongside your SimplePractice-generated income, creating a true, holistic P&L.

This approach not only centralizes your financial data but also enhances accuracy and simplifies tax preparation. It allows you to customize your financial reports to your specific business needs, ensuring you're always looking at the most relevant metrics. To unlock advanced strategies for combining your SimplePractice data with other tools and platforms, learn how to Enhance SimplePractice financial tracking for a more complete financial overview.

Strategic Insights for Practice Growth and Tax Preparedness

Ultimately, the goal of understanding your P&L is not just compliance, but growth. A well-constructed and regularly analyzed P&L statement empowers you to make strategic business decisions. It helps you identify which services are most profitable, where you might cut costs, and when it’s the right time to invest in new staff or marketing initiatives. This forward-looking approach transforms financial data from a chore into a powerful strategic asset.

Beyond daily operations, accurate P&L statements and other financial reports are absolutely essential for tax season. They provide the clear, documented evidence of your income and expenses that your accountant needs, significantly simplifying the process and minimizing stress. Being proactive with your financial reporting means you're always prepared, giving you peace of mind and more time to focus on your clients. For a comprehensive guide on leveraging all your financial documents for both expansion and compliance, be sure to explore our Essential financial reports guide Unlock practice insights.

Charting Your Practice's Financial Future

While SimplePractice shines as an invaluable tool for managing the income side of your private practice, generating a full Profit and Loss statement involves a strategic combination of its robust reporting features with your own diligent expense tracking. By exporting your detailed income reports and integrating them with your comprehensive expense data, you gain unparalleled clarity into your practice’s financial performance. This approach empowers you to move beyond simply tracking transactions to truly understanding profitability, making smarter decisions, and confidently charting a path for sustained growth and success.