Navigating the financial currents of your private practice can feel like a daunting task, but understanding your Essential Financial Reports for Private Practice Growth & Tax Prep is the bedrock of stability and expansion. It’s not just about crunching numbers; it’s about translating those numbers into a clear narrative for your business, empowering you to make smart, strategic decisions that fuel both current operations and future aspirations. Think of your financial reports as your practice’s vital signs – they reveal its health, identify areas needing attention, and highlight opportunities for robust growth.

At a Glance: Your Financial Compass for Private Practice

- Separate Business & Personal: Always maintain distinct accounts to simplify tracking and avoid confusion.

- Master Bookkeeping Basics: Accurate record-keeping isn't just for taxes; it's for daily financial intelligence.

- Know Your Big Three Reports: Understand the Profit & Loss Statement, Balance Sheet, and Cash Flow Statement.

- Spot Trends, Not Just Numbers: Use reports to identify seasonal shifts, profitable services, and spending patterns.

- Optimize for Growth: Leverage financial data to refine pricing, manage expenses, and diversify income.

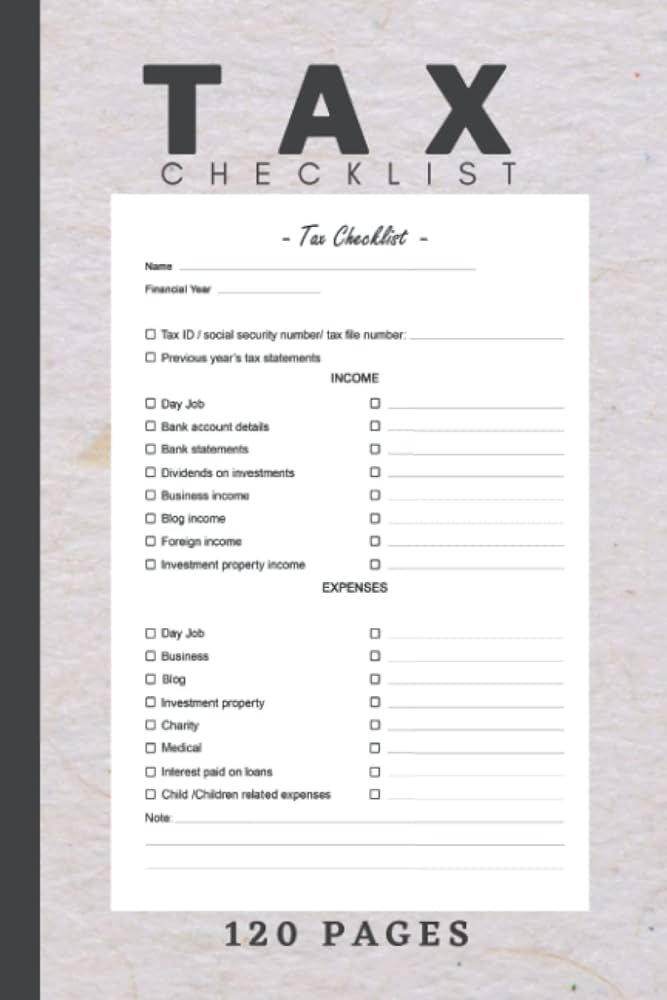

- Simplify Tax Season: Well-maintained reports make tax filing smoother, reduce stress, and ensure compliance.

- Embrace Technology: Utilize billing, expense tracking, and financial planning software to automate and streamline.

Why Financial Reports Are Your Practice's North Star (Beyond Tax Season)

Many private practice owners view financial reports solely through the lens of tax season, a necessary evil for compliance. But that's like only checking your car's fuel gauge when it's empty. True financial stability and strategic growth require a business-minded approach, where financial statements are consulted regularly, not just annually. They are indispensable tools for managing operational expenses, adapting to fluctuating client volume, and navigating unpredictable income streams.

Your journey toward a strong financial foundation begins with a clear, unwavering distinction between your business finances and personal expenses. Establish dedicated business bank accounts, including a separate savings account, and meticulously track every business-related transaction. This simple separation is perhaps the most crucial first step in bringing clarity to your financial world and preparing you to truly understand your reports.

The Cornerstone: What Accurate Bookkeeping Delivers

Before you can even look at a report, you need the raw data, and that’s where accurate bookkeeping shines. It’s the unsung hero of private practice finance, offering profound benefits that extend far beyond mere record-keeping.

Efficient Income and Expense Tracking

Bookkeeping systematically records every dollar that enters your practice (from client payments, insurance reimbursements, product sales, etc.) and every dollar that leaves (rent, utilities, software, office supplies, professional development, licensing fees). This detailed tracking allows you to make informed spending decisions and quickly pinpoint any unnecessary expenditures.

Stress-Free Tax Season Preparation

Organized financial records are your best friend when tax season rolls around. They simplify the filing process immensely, ensuring you can easily claim all eligible deductions – from your home office and health insurance premiums to mileage and continuing education costs. Not only does this save you money, but it also significantly reduces the risk of an IRS audit, giving you invaluable peace of mind. Bookkeeping software, in particular, can generate essential reports like profit and loss statements with just a few clicks.

Profitability Identification and Growth Insights

Up-to-date bookkeeping acts as a real-time assessment of your practice's profitability. It helps you identify your most lucrative services, understand if your current revenue sufficiently covers expenses for future growth, and track the impact of seasonal changes on your income. Armed with this knowledge, you can set realistic goals for expansion, confidently invest in new services, or adjust your marketing efforts.

Improved Cash Flow Management

Understanding the precise ebb and flow of money into and out of your practice is crucial. Bookkeeping provides this clarity, allowing you to strategically time expenditures, ensure you have sufficient funds for essential operating costs, and prepare effectively for slower periods. This proactive approach to cash flow management strengthens your practice's financial resilience.

Simplified Client and Insurance Billing

Detailed records of client payments, insurance claims, and outstanding balances streamline your entire billing process. This ensures accurate invoicing, provides proper documentation for insurance claims, and makes efficient follow-up on outstanding payments straightforward. No more chasing down missed payments or questioning billing discrepancies.

Compliance with Financial Regulations

Maintaining accurate records isn't just good business practice; it's a regulatory requirement. Bookkeeping ensures your practice complies with both industry-specific regulations (e.g., insurance, Medicaid/Medicare) and general financial regulations (e.g., tax filings). This diligence protects your practice from penalties and legal complications.

Streamlined Financial Reporting for Lenders or Investors

If you ever plan to secure a loan to expand your practice, hire new staff, or invest in significant assets, accurate financial statements are non-negotiable. Profit and loss statements, balance sheets, and cash flow statements, all derived from solid bookkeeping, provide the credible data lenders need to assess your practice's viability and creditworthiness.

Your Essential Financial Reports Explained

While comprehensive bookkeeping lays the groundwork, it’s the analysis of specific financial reports that transforms raw data into actionable intelligence. These are the three pillars you need to understand.

1. The Profit & Loss Statement (P&L) / Income Statement

What it is: Often called an Income Statement, the P&L provides a summary of your practice’s revenues, costs, and expenses over a specific period (e.g., a month, quarter, or year). It shows you how much profit or loss your practice generated during that time.

What it tells you:

- Revenue Streams: Where your income is coming from.

- Operating Expenses: All the costs associated with running your practice.

- Net Profit/Loss: The bottom line – whether you made money or lost money.

- Taxable Income: A crucial figure for tax planning.

How to use it for growth: - Identify Profitable Services: Are your cash-pay services outperforming insurance reimbursements? Your P&L helps you see which offerings truly drive your income.

- Spot Overspending: Are administrative costs creeping up? Is your software subscription too high compared to its value?

- Analyze Seasonal Trends: A P&L helps you visualize if certain times of the year are more lucrative or leaner, allowing you to plan ahead with marketing or expense adjustments.

- Make informed decisions about pricing: Understanding your profit margins from your P&L is crucial when evaluating billing models, comparing private-pay to insurance reimbursements for profitability, and adjusting rates based on overhead costs and financial goals. For those using platforms like SimplePractice, understanding your SimplePractice P&L reporting capabilities can streamline this analysis.

2. The Balance Sheet

What it is: Unlike the P&L, which covers a period of time, the Balance Sheet is a snapshot of your practice’s financial health at a specific point in time (e.g., December 31st). It follows the fundamental accounting equation: Assets = Liabilities + Owner’s Equity.

What it tells you:

- Assets: What your practice owns (cash, accounts receivable, equipment, property).

- Liabilities: What your practice owes (accounts payable, loans, credit card debt).

- Owner’s Equity: The owner's stake in the business (what's left after liabilities are subtracted from assets).

How to use it for growth: - Assess Financial Stability: A healthy balance sheet shows you have more assets than liabilities, indicating a stable practice.

- Track Growth in Equity: As your practice grows and becomes more profitable, your owner's equity should increase.

- Evaluate Debt Levels: Are you taking on too much debt? The balance sheet provides clarity on your financial obligations.

- Prepare for Loans: Lenders will scrutinize your balance sheet to assess your practice’s ability to repay debt.

3. The Cash Flow Statement

What it is: This report tracks all cash that comes into and goes out of your practice over a period. It categorizes cash flows into three main activities: operating, investing, and financing.

What it tells you:

- Liquidity: How much cash your practice actually has on hand at any given moment.

- Where Cash Goes: Whether cash is being generated from your core services or from other activities like investments or loans.

- Ability to Pay Bills: Whether you have enough cash to cover your immediate expenses, pay yourself, and maintain a cash cushion.

How to use it for growth: - Manage Your Cash Cushion: This statement is critical for ensuring you maintain a buffer for unexpected expenses, strengthening your financial resilience.

- Strategic Timing of Expenditures: If you know when your cash inflows are typically high, you can plan larger purchases or investments accordingly.

- Identify Cash Flow Bottlenecks: Are you struggling to collect payments? The cash flow statement can highlight issues with your payment policies or billing processes. This aligns with the need to implement structured payment policies, use online payments, send reminders, and offer payment plans.

Decoding Your Reports for Strategic Growth

Having these reports in hand is only half the battle. The real power lies in interpreting them to drive your practice forward.

Optimizing Your Revenue Streams

Your financial reports are invaluable for evaluating where your income comes from and how you might expand it. Diversifying income streams is a cornerstone of maintaining steady revenue and expanding business opportunities.

- Expand Cash-Pay Services: If your P&L shows higher profit margins from private-pay clients, consider strategically marketing these services more aggressively.

- Offer Online Courses & Workshops: Leverage your expertise by developing new offerings. This can be a significant non-clinical income stream.

- Provide Specialized Programs: Think about niche offerings like psychiatric or allied health programs, or group therapy modules that cater to specific needs.

- Develop Subscription Models: Membership programs or long-term therapy packages can provide more predictable recurring revenue, smoothing out cash flow.

Mastering Expense Management

Every dollar saved is a dollar earned. Your P&L and Cash Flow Statement are crucial tools for effective expense management.

- Track Fixed & Variable Costs: Distinguish between recurring costs (rent, insurance) and those that change with client volume (supplies, marketing spend). This helps you identify "financial leaks" – unnecessary or inefficient spending.

- Review Overhead Costs Regularly: Are you paying for software you don't use? Can you negotiate better rates with vendors for utilities or supplies?

- Cut Unnecessary Expenses: Be ruthless but strategic. Every line item on your P&L should justify its existence.

- Consider a Billing Specialist: If collection efforts are consistently lagging, a billing specialist can significantly improve your cash flow and free up your time for clinical work.

- Leverage Technology: Financial planning software can automate tracking of business savings, taxable income, and overall financial goals, giving you a clear picture of where your money is going and helping you stay on budget.

Setting Your Pricing for Profitability

Your P&L is the ultimate guide to ensuring your pricing structure supports your practice's growth and covers all operational expenses.

- Evaluate Billing Models: Compare the profitability of private-pay vs. insurance reimbursements. Understand the true cost of each.

- Adjust Rates Strategically: Your rates should not only cover your overhead but also allow for personal income and practice growth. Review industry trends to remain competitive and ensure your services are appropriately valued.

- Incorporate a Profit First Model: This system (allocating percentages of income to profit, owner's pay, operating expenses, and taxes before spending) can fundamentally shift your financial planning approach, prioritizing profitability from the outset.

Tax Prep Made Easy: Leveraging Your Reports for a Smooth Season

The annual scramble for tax documents can be a major source of stress. With well-maintained financial reports, however, tax season can become a remarkably smooth process.

Your P&L statement will clearly lay out your gross income and itemized expenses, making it straightforward to calculate your taxable income. Your bookkeeping records provide the detailed backup for every deduction.

- Claim Eligible Deductions: Remember to track and claim deductions for your home office, health insurance premiums (if self-employed), mileage for business-related travel, continuing education, professional memberships, and software subscriptions. Your expense tracking tools are vital here.

- Reduce Audit Risk: Organized, accurate records are your best defense against an IRS audit. If questions arise, you’ll have all the documentation readily available.

- Collaborate with Your Accountant: Provide your accountant with clean, categorized P&L statements, Balance Sheets, and detailed expense reports. This saves them time (and you money) and ensures they have everything they need to file accurately and identify all possible tax advantages.

Technology Tools That Lighten the Load

In today’s digital age, managing your practice's finances doesn't have to be a manual, time-consuming chore. A suite of robust financial tools can automate, streamline, and simplify your essential financial reporting.

- Billing and Collection Software: Tools like SimplePractice, TherapyNotes, or TheraPlatform not only manage scheduling and notes but also handle invoicing, payment processing, and insurance claim submissions, ensuring timely payments and accurate records.

- Expense Tracking Tools: Dedicated apps or features within broader accounting software (like QuickBooks, Xero, FreshBooks, or Wave) allow you to categorize expenses, link bank accounts, and even snap photos of receipts, making it easy to identify unnecessary costs and track deductions.

- Financial Planning Platforms: These tools help monitor your overall finances, track progress toward financial goals, and manage your business savings and investments.

- Marketing Automation Tools: While not directly financial, these tools (like email marketing platforms or social media schedulers) can attract clients without excessive spending, optimizing your marketing ROI which directly impacts your P&L.

Embracing these technologies not only makes bookkeeping easier but also facilitates seamless collaboration with your accountant or bookkeeper, allowing them to access your financial data directly and efficiently.

Building Long-Term Financial Resilience

A thriving private practice isn’t just about making it through the next month; it’s about strategically planning for years to come. Your financial reports are key to this foresight.

- Maintain a Strong Cash Cushion: Revisit your cash flow statement regularly to ensure you have several months of operating expenses set aside. This protects your practice from unexpected dips in client volume or unforeseen expenses.

- Develop Expansion Plans: Use the insights from your P&L to fund growth initiatives. This could include hiring administrative staff, adding new specialized services, or investing in advanced professional development for yourself or your team.

- Consult with a Financial Planner: A financial planner specializing in small businesses or private practices can offer strategic insights, help you set realistic financial goals, and develop a comprehensive roadmap for future success. Their expertise can be invaluable for navigating complex investment decisions or planning for retirement.

- Adapt Business Strategies: Regularly monitor industry trends and compare them against your own financial performance. Are new service models emerging? Is technology changing client expectations? Be prepared to expand services or refine marketing efforts to maintain relevance and profitability.

Your Next Steps: Turning Insight into Action

Understanding your essential financial reports is a powerful leap toward a more stable and prosperous private practice. It transforms you from a reactive participant in your finances to a proactive architect of your business’s future.

Start by dedicating time each month to review your P&L, Balance Sheet, and Cash Flow Statement. Don't just glance; actively seek patterns, ask questions, and identify actionable insights. If you haven't already, implement a robust bookkeeping system, whether it’s a dedicated software or a qualified bookkeeper. Take that first step to clearly separate your business finances from your personal ones.

Remember, your financial reports aren't just for your accountant; they are for you. They are your most reliable guide for making informed decisions, optimizing your operations, and confidently steering your private practice toward sustained growth and financial health.