The numbers in your practice's Profit & Loss (P&L) statement aren't just figures; they're a detailed narrative of your operational health, a compass for strategic decisions, and, quite frankly, the key to interpreting your practice's Profit & Loss Statement for sustained success. Understanding this vital financial document isn't just for accountants; it's a critical skill for any practice owner or manager looking to make informed choices that truly impact the bottom line. Think of it as your practice's annual physical, but instead of blood pressure and cholesterol, it's measuring revenue, expenses, and, ultimately, profitability.

Without a clear grasp of your P&L, you’re essentially flying blind. You might feel busy, but are you truly profitable? Are your services priced correctly? Are you spending too much on supplies or administrative overhead? This guide will cut through the jargon, empowering you to read your P&L not just as a report, but as a roadmap to a more financially robust practice.

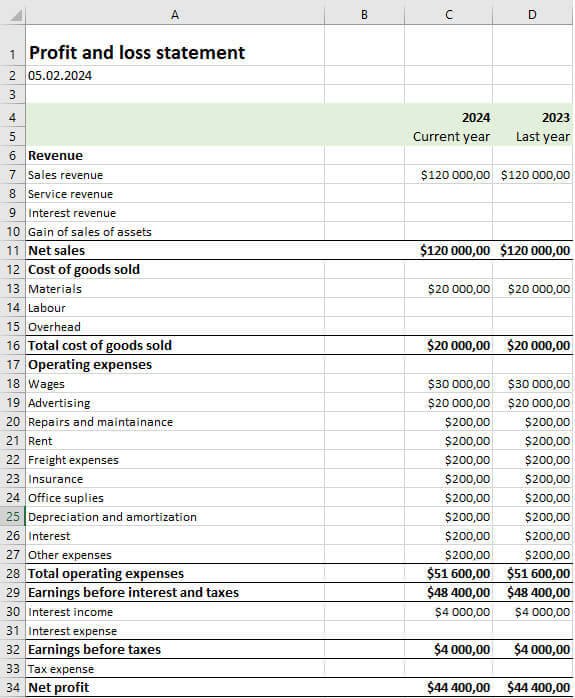

At a Glance: Your P&L in a Nutshell

Before we dive deep, here are the essential takeaways you'll gain from mastering your Profit & Loss statement:

- Financial Performance Snapshot: It shows your practice's income and expenses over a specific period (month, quarter, year).

- Revenue vs. Expenses: The core of the P&L is comparing what came in (revenue) to what went out (expenses).

- The Bottom Line: It reveals your Net Income – the ultimate profit or loss after all calculations.

- Strategic Decisions: Understanding it helps you identify trends, control costs, price services, and plan for growth.

- Not Cash Flow: It's crucial to remember that profit isn't the same as cash in the bank; the P&L reports when income is earned and expenses incurred, not necessarily when cash changes hands.

- Regular Review is Key: Consistent analysis (monthly, quarterly) is vital for proactive management.

The Heartbeat of Your Practice: What a P&L Really Tells You

Imagine your practice as a living organism. Its financial heartbeat is recorded in a few core documents: the Balance Sheet, which gives you a snapshot of assets and liabilities at a single moment, and the Profit & Loss (P&L) statement. While the Balance Sheet is like a static photo, the P&L is a video, capturing the dynamic flow of money over a specific period – typically a month, quarter, or an entire year.

Also known as an income statement, the P&L strips away complexity to answer a fundamental question: "How much money did my practice make (or lose) during this time?" It lays out your total revenue, subtracts all your expenses, and reveals the resulting profit or loss. For any practice owner, this is ground zero for understanding financial health, making informed decisions, and preparing for tax season.

Where Does This Magic Come From?

The information for your P&L originates directly from your meticulous bookkeeping records. Every service provided, every payment received, every supply ordered, and every utility bill paid contributes to the story your P&L tells.

To generate it, a bookkeeper or accountant summarizes all revenue streams and all expenses for the chosen period. These totals are then used to calculate the various stages of profit. Many modern bookkeeping software solutions, like QuickBooks or even specialized practice management software, come with built-in functions that can generate P&L reports with relative ease.

However, a critical truth underpins the entire process: the accuracy of your P&L depends entirely on the accuracy and completeness of your underlying bookkeeping. GIGO – "Garbage In, Garbage Out" – applies wholeheartedly here. If your records are sloppy, your P&L will be, too, leading you to potentially flawed conclusions about your practice's performance.

Dissecting the DNA: Key Components of Your P&L

Understanding each line item on your P&L is like learning the individual notes in a symphony. Together, they create a comprehensive picture. Let's break down the core elements you'll encounter.

Revenue: The Money Coming In

This is your top line, sometimes called Gross Income or Sales. It represents the total amount of money your practice earned from its services over the specified period. For healthcare practices, this includes:

- Service Revenue: Direct payments for patient consultations, procedures, and therapies.

- Payer Reimbursements: Funds received from insurance companies for covered services.

- Ancillary Services: Income from additional offerings like diagnostic tests, dispensed products, or wellness programs.

- Value-Based Care Payments: Revenue tied to specific health outcomes or quality metrics, increasingly relevant in modern healthcare.

This figure tells you how effective your practice is at generating income through its core activities.

Cost of Services Rendered (CoSR): The Direct Costs of Care

Often referred to as Cost of Goods Sold (COGS) in other industries, CoSR represents the direct costs associated with delivering your patient care. These are the expenses that increase proportionally with the number of services you provide. Examples include:

- Clinical Salaries & Benefits: Wages, payroll taxes, and benefits for your direct care providers (e.g., nurses, therapists, medical assistants).

- Medical Supplies: Consumables used during patient visits (e.g., bandages, gloves, medications).

- Lab Fees: Costs associated with sending out tests.

- Medical Malpractice Insurance: A direct cost of being able to provide services.

Subtracting CoSR from your Revenue gives you your Gross Profit, which tells an important story about the profitability of your actual patient care before other overheads.

Gross Profit: Your Core Clinical Muscle

Calculation: Revenue - Cost of Services Rendered

Gross Profit is a crucial metric because it reflects the profitability of your core clinical operations. It shows how much money is left over from your services after covering the direct costs of delivering them. A healthy gross profit indicates that your pricing, staffing, and direct supply costs are generally in good alignment. If this number is too low, it suggests issues with your service pricing, supply chain efficiency, or clinical staffing models.

Operating Expenses (OpEx): Keeping the Doors Open

Operating Expenses, or OpEx, are the indirect costs required to run your practice, distinct from the direct costs of service delivery. These are generally fixed or semi-fixed expenses that don't fluctuate directly with the number of patients seen. Examples include:

- Administrative Salaries: Wages for front desk staff, billing specialists, and practice managers.

- Rent & Utilities: The cost of your physical space, electricity, water, and internet.

- EHR and Software Costs: Subscriptions for electronic health record systems, practice management software, and other digital tools.

- Marketing & Advertising: Costs incurred to attract and retain patients.

- Office Supplies: General consumables not directly tied to patient care.

- Legal & Accounting Fees: Professional services necessary for compliance and financial management.

Managing OpEx effectively is key to overall profitability, as these costs can easily creep up and erode your gains.

Operating Income: Performance Before the Extras

Calculation: Gross Profit - Operating Expenses

Operating Income (sometimes called Earnings Before Interest and Taxes, or EBIT) reveals your practice's profitability from its primary business activities, before accounting for non-operational items like interest payments or taxes. This figure tells you how well your practice is managing both its direct service costs and its general overhead. It's a strong indicator of your operational efficiency. A strong operating income suggests that your core business model is sound.

EBITDA: A Look at Pure Operational Strength

Calculation: Operating Income + Depreciation + Amortization

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a commonly used metric, particularly when evaluating a business's core operational profitability or comparing it to peers. By adding back non-cash expenses like depreciation (the decrease in value of assets over time) and amortization (similar for intangible assets), as well as interest and taxes, EBITDA attempts to give a clearer picture of a practice's earning potential from its operations alone, free from financing and accounting decisions. It’s often used in valuations or when considering significant investments.

Taxes & Interest: The Necessary Deductions

These line items account for payments related to debt (interest expense) and income taxes. Interest expenses are a cost of borrowing money, while taxes are, of course, a mandatory share of your profits paid to the government. These deductions come after your operational profitability has been determined.

Net Income: The Bottom Line Truth

Calculation: Operating Income - Interest - Taxes (or all Revenue - all Expenses)

Net Income, often simply called Profit or Loss, is the grand finale of your P&L. This is the ultimate "bottom line" figure. A positive Net Income means your practice made money during the period, while a negative number indicates a loss. This figure represents what your practice truly earned after all expenses – both direct and indirect, operational and non-operational – have been accounted for. It's the ultimate measure of your practice's profitability and a key indicator of its financial health.

Beyond the Numbers: Unlocking Insights with Key Profit Margins

While the absolute dollar figures on your P&L are important, converting them into percentages – known as profit margins – unlocks even deeper insights. Margins allow you to compare your practice's performance over different periods, against industry benchmarks, and even between different service lines, regardless of overall revenue size.

Gross Profit Margin: How Efficient Are Your Services?

Formula: (Gross Profit / Revenue) x 100

This margin tells you what percentage of your revenue is left after covering the direct costs of delivering your services. A high gross profit margin indicates efficient clinical operations – perhaps your pricing is strong, your clinical staffing is optimized, or your supply costs are well-managed. A declining gross profit margin could signal that your service pricing is too low, your clinical staff wages are too high relative to revenue, or your cost of supplies is increasing. This is a primary target for improving service-level profitability. You might look at renegotiating supplier contracts or analyzing your service pricing strategy.

Operating Profit Margin: Your Overall Operational Health

Formula: (Operating Income / Revenue) x 100

The operating profit margin reflects the percentage of revenue remaining after covering both the direct costs of services and all your general operating expenses. This is a comprehensive measure of your practice's overall operational efficiency. It shows how well you're managing all costs associated with running the business before accounting for interest and taxes. A strong operating margin indicates effective cost control across the board. If this margin is slipping, it's time to scrutinize your administrative workflows and overhead costs. For example, are you maximizing your practice management software's capabilities or is there an opportunity to streamline administrative tasks to reduce expenses?

Net Profit Margin: What You Actually Keep

Formula: (Net Income / Revenue) x 100

The net profit margin is the ultimate "bottom line" percentage. It tells you what percentage of every dollar of revenue your practice keeps as profit after all expenses, including interest and taxes. This is the purest measure of your practice's overall financial success. It's the number that truly reflects how much wealth your practice is generating for its owners. A healthy net profit margin means you have funds available for reinvestment, debt reduction, or owner distribution. Consistent improvement in this margin is a sign of a well-managed and financially thriving practice.

Your Step-by-Step Guide to Interpreting Your P&L Like a Pro

Now that you understand the components, let's walk through a structured approach to interpreting your P&L. This isn't just about glancing at the bottom line; it's about digging deeper to find actionable insights.

Step 1: The High-Level Snapshot

Start with a quick scan. What are your Total Revenue and your Net Income?

- Is revenue growing or shrinking compared to the last period?

- Is Net Income positive or negative?

- Does the overall picture seem healthy, or do alarm bells go off immediately?

This initial overview gives you a general sense of your practice's financial performance.

Step 2: Comparative Analysis – Unearthing Trends

This is where the real detective work begins. Looking at a single P&L in isolation tells you little. Its power comes from comparison.

Period-Over-Period: Tracking Growth (or Shrinkage)

Compare your current P&L to previous periods.

- Month-over-month: Helps identify immediate operational shifts, seasonal variations, or the impact of recent decisions. For example, did a new marketing campaign translate into higher revenue?

- Quarter-over-quarter: Useful for tracking trends related to quarterly goals or seasonal patient flows.

- Year-over-year (same month/quarter): This is particularly powerful for neutralizing seasonality. Comparing July of this year to July of last year gives you a much cleaner picture of true growth or decline, rather than just seasonal ebbs and flows.

- Look for: Significant spikes or drops in revenue, unexpected increases in specific expense categories ("expense creep"), or shifts in profit margins. Understanding these trends is crucial for forecasting and proactive management.

Budget-to-Actual: Are You On Track?

If your practice operates with a budget (and it absolutely should!), compare your actual P&L figures against your budgeted projections.

- Identify variances: Where did you overspend? Where did you underperform on revenue?

- Understand the "why": Was an expense higher due to unforeseen circumstances (e.g., emergency repair) or a systematic issue (e.g., rising supply costs)? Was revenue lower due to fewer patient visits or lower reimbursement rates?

- Adjust and adapt: Use these variances to refine future budgets and adjust your operational strategies. If you’re consistently over budget on a certain item, it’s time to find strategies for reducing practice expenses or re-evaluate your spending assumptions.

Step 3: Vertical Analysis – The Financial DNA

Vertical analysis is a powerful technique where every line item on your P&L is expressed as a percentage of your total revenue. This allows you to see the "financial DNA" of your practice and benchmark it.

- Example: If your rent is $3,000 and your total revenue is $30,000, your rent is 10% of your revenue.

- What it reveals: This immediately highlights disproportionate costs. Is 40% of your revenue going to administrative salaries? Is your malpractice insurance consuming a higher percentage than the industry average?

- Benchmarking: Once you have these percentages, you can compare them against industry averages for similar practices. This helps identify areas where your practice might be significantly less (or more) efficient than your peers. If your clinical salaries are 25% of revenue but the industry average is 20%, it flags an area for investigation.

Turning Numbers into Action: Strategic Decisions Driven by Your P&L

The real value of P&L interpretation lies in its ability to guide strategic decisions. Let's look at how to translate insights into action.

Boosting Your Gross Margins: More Bang for Your Clinical Buck

If your Gross Profit Margin is squeezed, focus on these areas:

- Service Pricing: Are your fees competitive yet profitable? Have you reviewed your pricing lately against rising costs?

- Payer Contracts: Are you negotiating favorable reimbursement rates with insurance companies?

- Clinical Staffing Optimization: Are you appropriately staffing for patient volume? Could cross-training improve efficiency? Are there ways to optimize your provider schedules to see more patients without compromising care quality?

- Supply Chain Management: Can you renegotiate with suppliers for better rates? Are you bulk buying where appropriate? Are there less expensive but equally effective alternatives?

Taming Operating Expenses: Smart Spending for Smarter Growth

When OpEx is eating too much of your revenue, consider:

- Technology & Automation: Invest in efficient systems (e.g., advanced practice management software, automated billing) to reduce manual labor costs and improve accuracy. This can lead to significant savings over time. For instance, knowing how to leverage your existing software, such as by Creating P&L in SimplePractice directly, can cut down on external accounting costs.

- Workflow Streamlining: Identify and eliminate redundant administrative tasks. Could a virtual assistant handle some tasks more cost-effectively?

- Overhead Scrutiny: Regularly review costs like utilities, office supplies, and even marketing spend. Are you getting a good ROI on your advertising? Can you go paperless to reduce printing costs?

- Lease Renegotiation: When your lease is up, explore options for better rates or smaller, more efficient spaces if feasible.

Guiding Growth & Investment: Where to Put Your Next Dollar

Your P&L can tell you where to invest for maximum impact:

- High-Margin Service Lines: If your P&L shows consistent profitability in certain services, consider expanding those offerings or dedicating more resources to them.

- New Equipment/Technology: If a new piece of equipment promises to increase efficiency or allow for higher-margin services, your P&L can help you project its potential impact on revenue and expenses.

- Staffing Decisions: Is your practice growing to the point where hiring another provider or administrative staff member would directly lead to higher revenue that offsets their cost? Your P&L helps model these scenarios.

Navigating the Minefield: Common P&L Traps to Avoid

Even experienced business owners can fall into common P&L interpretation pitfalls. Being aware of these traps will help you make more accurate assessments.

The Revenue Illusion: Don't Chase Top-Line Alone

It's tempting to focus solely on Total Revenue. A big revenue number feels good, right? But high revenue with equally high (or higher) expenses means little to no profit. True profitability is about what your practice keeps after all costs, not just what it brings in. Always balance revenue growth with rigorous cost control. A practice with lower revenue but excellent expense management can often be more profitable than a high-revenue, high-spending one.

Profit vs. Cash: They're Not the Same!

This is perhaps the most common and dangerous misconception. Your P&L shows profitability, which is based on when revenue is earned and expenses are incurred (accrual accounting), regardless of when the cash actually changes hands. For example, you might provide a service today, count it as revenue, but not receive payment from the insurance company for 60 days. Meanwhile, you pay your staff every two weeks.

A practice can be profitable on paper but still run out of cash if payments are delayed or significant cash outflows occur. This is why you also need to be adept at optimizing your practice's cash flow by reviewing your Statement of Cash Flows. This separate financial statement tracks the actual movement of cash into and out of your business, which is essential for day-to-day liquidity.

The One-Time Blip: Spotting Irregularities

Be wary of unusual or non-recurring items that can distort your P&L for a specific period.

- One-time windfalls: Selling an old piece of equipment or receiving a large, unexpected grant can inflate revenue for a month, masking underlying weaknesses.

- One-time expenses: A major legal settlement, a large equipment repair, or a significant software upgrade can make a month look artificially unprofitable.

Always look for the underlying, recurring trends. Is the increase or decrease a fundamental shift, or just a temporary anomaly? Exclude these one-off events when comparing performance over time to get a truer picture.

Ignoring the Balance Sheet: The Other Half of the Story

While the P&L tells you about performance over time, it doesn't give you the full picture of your financial position. For that, you need to understand your Balance Sheet. The P&L tells you if you made a profit, but the Balance Sheet tells you what assets you own and what you owe (liabilities) at a specific point. For example, a P&L might show a great profit, but if your Balance Sheet reveals a huge amount of accounts receivable (money owed to you) that isn't being collected, you still have a problem. Effective financial management requires understanding your practice's balance sheet in conjunction with your P&L.

When and How Often to Review Your P&L?

The frequency of your P&L review depends on your goals:

- Monthly Review (Operational Control): For day-to-day operational management, a monthly review is essential. It allows you to catch expense overruns early, respond to revenue dips promptly, and make tactical adjustments to staffing, marketing, or pricing. This is where you monitor the pulse of your business.

- Quarterly Review (Strategic Planning): A quarterly review provides a broader perspective, allowing you to assess the impact of major decisions, evaluate longer-term trends, and adjust your strategic plan. This is where you measure progress against larger goals and make more significant shifts.

- Annual Review (Comprehensive Health Check): An annual P&L provides the complete picture for tax purposes, comprehensive performance review, and setting the stage for the next year's budget and strategic direction.

Making P&L Generation Easier: Tools and Tips

Generating an accurate P&L doesn't have to be a Herculean task.

The Role of Good Bookkeeping

This cannot be overstated. Consistent, accurate, and categorized bookkeeping is the foundation of a reliable P&L. If every transaction is properly recorded and categorized (e.g., "rent," "medical supplies," "admin salaries"), generating a useful P&L becomes a straightforward process. If your bookkeeping is a mess, your P&L will reflect that chaos.

Leveraging Software

Modern accounting and practice management software solutions are invaluable. Products like QuickBooks, Xero, or even industry-specific platforms often have robust reporting features that can generate P&Ls with just a few clicks. This automation saves time and reduces human error. Familiarity with your software's reporting capabilities, such as for Creating P&L in SimplePractice, is a significant advantage.

When to Bring in an Expert

Don't hesitate to engage a professional bookkeeper or accountant. While you should understand how to interpret your P&L, you don't necessarily have to be the one generating it. Outsourcing this task to experts ensures accuracy, compliance, and frees up your time to focus on patient care and practice growth. An accountant can also provide deeper insights and strategic financial advice that goes beyond basic report generation.

Your Practice's Financial Story: Moving Forward with Confidence

Interpreting your practice's Profit & Loss statement is more than just a numbers game; it's about understanding the story your business is telling you. It’s about being proactive rather than reactive. By regularly reviewing your P&L with a structured approach – scanning the high-level figures, comparing against past performance and budgets, and conducting vertical analysis – you gain clarity. This clarity empowers you to identify financial opportunities, pinpoint inefficiencies, and make strategic decisions that genuinely move your practice towards greater profitability and sustainability.

Don't let the numbers intimidate you. With these insights, you're not just reading a report; you're becoming the informed leader your practice deserves, ready to guide it confidently toward a prosperous future.