Your Practice, Your Profit: A Step-by-Step Guide to Generating SimplePractice's Profit & Loss Report

Understanding the financial pulse of your private practice is non-negotiable for long-term success. While the daily flow of clients and appointments keeps you busy, regularly generating a Profit & Loss (P&L) Report in SimplePractice is the secret weapon for turning client care into sustainable growth. This comprehensive guide will walk you through everything you need to know, from the basics of what a P&L is, to the exact clicks within SimplePractice, and how to actually use the insights to propel your practice forward.

At a Glance: Key Takeaways for Your SimplePractice P&L

- What it is: A P&L (also known as an Income Statement) shows your practice's revenues, expenses, and net profit or loss over a specific period (month, quarter, year). It's a snapshot of your profitability.

- Why it matters: It helps you assess financial health, track performance, prepare for taxes, identify cost savings, and develop smart revenue strategies.

- SimplePractice makes it easy: The platform automates much of the data collection, streamlining the reporting process.

- Key components: Look for your total income (revenue) and various expenses to see your final net profit.

- Cash vs. Accrual: Understand the difference in how income and expenses are recorded—SimplePractice typically defaults to a cash-based report, but it's good to know the distinction.

- Actionable insights: Don't just generate it; analyze it. Compare periods, spot trends, and make informed decisions about your fees, marketing, and spending.

What Exactly is a Profit & Loss Report? (And Why Your Practice Needs One)

Think of a Profit & Loss (P&L) Report as your practice's financial report card. Also commonly called an Income Statement, it's a vital document that summarizes your business’s revenues, expenses, and ultimately, your net profit or loss over a specific period—be it a month, a quarter, or an entire year. Unlike a balance sheet that shows what you own and owe, the P&L hones in on your operational performance.

For independent practitioners and small businesses, the term "P&L" often feels more approachable than "income statement." Regardless of the name, its purpose remains clear: to give you a crystal-clear picture of your practice's ability to generate income, manage costs, and achieve profitability.

Why It's Your Practice's Financial GPS

You wouldn't navigate an unfamiliar city without a map, and you shouldn't navigate your practice's finances without a P&L. Here's why this report is indispensable:

- Assesses Profitability: At its core, the P&L tells you if you're making money or losing it. By comparing your earnings against your expenses, you get an immediate sense of your financial health. If you bring in $15,000 in a month but spend $8,000, your P&L will clearly show a $7,000 net profit.

- Tracks Financial Performance: Running P&L reports consistently allows you to compare performance across different periods. Did your expenses jump significantly last quarter? Did revenue dip in August? The P&L helps you spot these shifts and investigate the underlying reasons.

- Ensures Accurate Tax Reporting: Come tax season, your P&L is a critical document for calculating your taxable income. It helps ensure you account for all revenues and eligible deductions, preventing costly mistakes or missed savings.

- Identifies Cost-Saving Opportunities: By categorizing your expenses, the P&L highlights where your money is going. You might discover an unused software subscription, an overly expensive utility bill, or an opportunity to renegotiate with a vendor.

- Develops Smarter Revenue Strategies: Seeing your income broken down can help you identify which services or client types are most profitable. This insight guides decisions on marketing, fee adjustments, and resource allocation.

- Predicts Future Trends: Analyzing several P&L reports over time helps you recognize seasonal patterns, growth trajectories, and potential financial challenges before they become critical. This foresight is invaluable for strategic planning.

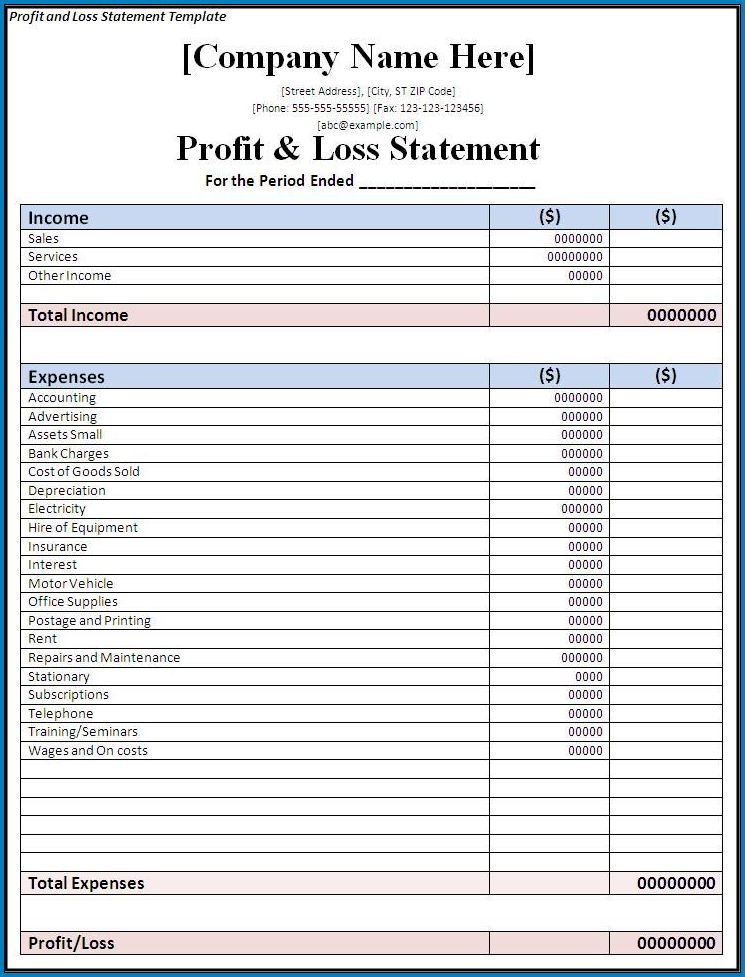

Understanding the P&L's Core Building Blocks

Before you dive into SimplePractice, it's helpful to understand the universal components that make up any P&L report. These are the categories you'll see, whether you're looking at a multinational corporation's financials or your own solo practice.

Revenue: Your Practice's Income Stream

This is the top line of your P&L, representing all the money your practice brings in from its services. In SimplePractice, this primarily includes payments from clients, insurance reimbursements, and any other income directly related to your clinical work. It's the total income earned before any expenses are deducted.

Expenses: Where Your Money Goes

Expenses are the costs you incur to run your practice. These are typically broken down into different categories to give you a clearer picture:

- Cost of Goods Sold (COGS): For a service-based business like a therapy practice, COGS might not always be directly applicable in the traditional sense (e.g., manufacturing costs). However, it could encompass direct costs associated with delivering a specific service, such as a contractor payment for a specialized group therapy session you subcontracted, or specific, client-facing materials directly consumed during a session. SimplePractice's P&L might group these differently.

- Operating Expenses (OPEX): These are the ongoing costs of running your practice that aren't directly tied to each specific service delivery. Think of your rent, utilities, administrative salaries (if you have staff), marketing efforts, insurance premiums, your SimplePractice subscription, and other software tools. These are the day-to-day costs of keeping your doors open.

- Non-Operating Expenses: These are costs not directly related to your core clinical services. Examples might include interest payments on a business loan, depreciation of office equipment, or any one-time losses from asset sales.

The "Profit" in Profit & Loss

Once you subtract your expenses from your revenue, you're left with your profit—or loss. The P&L typically shows a few levels of profit:

- Gross Profit: This is calculated as your Revenue minus your COGS. It shows how much money you have left after covering the direct costs of providing your services. For many therapy practices, where COGS is low or non-existent, gross profit is often very close to total revenue.

- Operating Income (or Operating Profit): This figure comes from subtracting your Operating Expenses from your Gross Profit. It reveals the profitability of your core business operations before accounting for non-operating costs or taxes.

- Net Income (or Net Profit/Loss): This is the ultimate bottom line. It's what's left after all expenses—operating, non-operating, and taxes—have been subtracted from your gross profit. This is the amount your practice truly earned (or lost) during the reporting period.

Cash vs. Accrual: Choosing Your Accounting Lens

When generating a P&L, it's crucial to understand the accounting method being used, as it impacts when revenue and expenses are recorded.

- Cash-Based P&L: This method records revenue when cash is actually received and expenses when cash is actually paid. It's straightforward and often preferred by smaller businesses and individual practitioners because it directly reflects the money moving in and out of your bank account. For example, if a client pays you $200 today for a session, that $200 is recorded as revenue today. If you pay your SimplePractice subscription on the 1st of the month, that expense is recorded on the 1st.

- Accrual-Based P&L: This method records revenue when it is earned (even if you haven't received the payment yet) and expenses when they are incurred (even if you haven't paid them yet). This offers a more accurate picture of your practice's financial performance over time, especially for businesses with significant accounts receivable (unpaid invoices) or accounts payable (unpaid bills). For example, if you provide a session in December and bill the client, but they don't pay until January, that revenue is still recorded in December.

SimplePractice typically generates cash-based financial reports by default. This is generally suitable for most private practices, offering a clear view of your actual cash flow. However, it's vital to be aware of this distinction, especially if you're working with an accountant who prefers an accrual basis for specific tax or financial planning purposes.

Ready to Run It? Your Step-by-Step Guide to Generating Your P&L in SimplePractice

SimplePractice streamlines the process of pulling your P&L, making it accessible even if you're not a financial wizard. Your client payments, insurance reimbursements, and practice expenses (if recorded in SimplePractice) are automatically compiled.

Step 1: Log In & Navigate to Reports

First things first, log into your SimplePractice account. Once you're in your dashboard, look for the "Reports" section in your left-hand navigation menu. This is your gateway to all your practice's financial data.

Step 2: Find the Profit & Loss Report

Within the "Reports" section, you'll see a list of various reports. Scroll down until you find the "Profit & Loss" report. It's usually nestled under a "Financial Reports" sub-heading. Click on it to proceed. This is the easiest way to Generate P&L with SimplePractice.

Step 3: Define Your Reporting Period

This is a critical step for an accurate P&L. SimplePractice will present you with options to select your desired date range:

- Presets: You'll likely see options like "Last Month," "This Quarter," "Last Year," etc. These are convenient for quick checks.

- Custom Date Range: For more specific analysis, you can choose custom "Start Date" and "End Date" fields. This allows you to generate a P&L for any period you need, whether it's a specific quarter, a unique fiscal year, or even just a few weeks.

Choose the period that aligns with your analysis goals. Monthly reports are great for granular insights, while quarterly or annual reports offer a broader view.

Step 4: Understand Your Display Options (Cash vs. Accrual)

As discussed, the accounting method matters. SimplePractice will usually default to "Cash Basis" for the P&L. Confirm this is the method you want to use. If SimplePractice offers an "Accrual Basis" option (and your accountant advises it), you would select it here. For most private practices, the Cash Basis P&L is appropriate and easier to understand.

Step 5: Generate & Review Your Report

Once your date range and accounting method are set, click the "Generate Report" or similar button. SimplePractice will then compile the data and display your P&L on screen.

Take a moment to review the report. You'll see:

- Income/Revenue: Your total earnings from client payments, insurance, etc., within the chosen period.

- Expenses: A breakdown of your practice expenses, often categorized (e.g., Office Expenses, Professional Development, Software Subscriptions).

- Net Profit/Loss: The final number at the bottom, indicating your overall profitability for the period.

Step 6: Export or Print for Your Records

After reviewing, you'll typically have options to:

- Export: SimplePractice often allows you to export the report as a PDF, CSV, or Excel file. Exporting to a spreadsheet (CSV/Excel) is particularly useful if you want to perform further analysis, add notes, or share with your accountant.

- Print: If you prefer a physical copy for your records, a print option will also be available.

It's good practice to save or print your P&L reports regularly (e.g., monthly) and store them securely, either digitally or physically.

Deciphering Your SimplePractice P&L: What the Numbers Tell You

Generating the report is only half the battle. The real value comes from understanding what the numbers are actually saying about your practice.

Spotting Trends in Revenue & Expenses

Look beyond just the totals. Examine individual line items for both income and expenses.

- Revenue breakdown: Are certain service codes generating more income than others? Is your insurance revenue consistent, or is there a noticeable fluctuation?

- Expense categories: Which expenses are the largest? Are any categories showing unexpected increases? For instance, a sudden spike in "Software Subscriptions" might mean you're paying for a tool you no longer use, or a jump in "Professional Development" could reflect a recent conference attendance.

Understanding Your Net Profit (or Loss)

The net profit or loss figure is your bottom line.

- Consistent Profitability: A healthy, consistent net profit indicates your practice is financially stable.

- Shrinking Profit Margins: If your net profit is decreasing while revenue stays the same, it suggests your expenses are increasing faster than your income. This warrants a deeper dive.

- Net Loss: A net loss means your expenses exceeded your revenue. While occasional losses can occur (e.g., a major investment in new equipment), a persistent loss needs immediate attention.

Comparing Periods for Deeper Insights

One P&L report is useful, but comparing multiple reports across different periods is where the magic happens.

- Month-over-Month (MoM): Compare January's P&L to February's. Are you seeing consistent growth? Is there a seasonal dip? This helps you react quickly to short-term changes.

- Quarter-over-Quarter (QoQ): A broader view that helps identify more stable trends and evaluate the impact of recent strategic changes.

- Year-over-Year (YoY): Essential for long-term planning and understanding your practice's growth trajectory. Comparing this year's Q1 to last year's Q1 gives you a strong indicator of progress.

For example, if you see revenue growth of 20% MoM but your net profit only increased by 5%, you'll want to examine your expenses to see what's eating into that increased income.

Avoiding Common P&L Pitfalls (Even in SimplePractice)

Even with SimplePractice making things easier, certain mistakes can skew your P&L and lead to misinformed decisions.

- Misclassifying Personal vs. Business Expenses: This is a big one for solo practitioners. Mixing personal expenses with business expenses in SimplePractice (or anywhere) will completely distort your P&L, making your practice look less or more profitable than it actually is. Be meticulous about separating funds and tracking.

- Not Tracking All Expenses Properly: While SimplePractice manages income, you need to ensure all business expenses (rent, utilities, marketing, professional development, etc.) are recorded accurately, either directly in SimplePractice (if applicable) or in a linked accounting software. Missing expenses inflates your reported net income, leading to an inaccurate picture and potentially higher tax liability.

- Ignoring Depreciation and Amortization: These are non-cash expenses that account for the wear and tear of assets over time. While SimplePractice might not automatically calculate these, your accountant will. Not factoring them in will artificially inflate your net income.

- Reviewing Only Annually: Waiting until year-end to look at your P&L is like only checking your gas tank when the light comes on. You miss opportunities to correct course. Businesses that review their financials weekly have significantly higher success rates than those reviewing annually.

- Looking at Totals Only: While the net profit is important, fixating solely on the bottom line or grand totals hides critical details. Monthly columns reveal seasonal variations, specific cost increases, or revenue dips that aggregated annual numbers obscure.

Turning Insights into Action: Beyond Just "Having" a P&L

The true power of your SimplePractice P&L lies in its ability to inform your strategic decisions. Don't let it just be a report you generate for your accountant; use it as a tool for growth.

Optimizing Your Fee Structure

- Analyze Service Profitability: If your P&L shows consistent high revenue but a relatively low net profit margin, it might indicate that your fees aren't keeping pace with your expenses.

- Value-Based Pricing: Understand the gross profit generated by different services. If individual therapy is highly profitable but group sessions are barely breaking even after accounting for your time and resources, you might consider adjusting your pricing or marketing focus.

Identifying Cost-Saving Opportunities

- High-Cost Categories: Your P&L will highlight your largest expense categories. Dive into these. Can you find a more affordable alternative for your office supplies? Are there redundant software subscriptions you can cancel?

- Negotiate & Optimize: Use your P&L data to renegotiate with vendors (e.g., internet provider, cleaning service). Knowing your costs empowers you to make smarter choices.

Planning for Growth & Expansion

- Budgeting: Use historical P&L data to create realistic future budgets. If you plan to hire an administrative assistant next year, your P&L helps you project the impact of that salary on your profitability.

- Investment Decisions: Considering a move to a larger office or investing in new technology? Your P&L helps you assess if your current profits can comfortably support these new expenses or if you need to boost revenue first.

- Align Targets with Capabilities: Ensure your sales and production goals are realistic and supported by operational capacity and market demand. A P&L can show you if you're over-extending or under-utilizing your resources.

Preparing for Tax Season with Confidence

- Organized Records: A well-maintained P&L from SimplePractice provides a clear summary of your income and expenses, making tax preparation smoother and less stressful.

- Maximize Deductions: By clearly categorizing expenses throughout the year, you ensure you don't miss any eligible deductions that can lower your taxable income.

P&L Analytics: The Next Level of Financial Mastery

Once you're comfortable generating and understanding your P&L, you can apply some basic analytical methods to extract even deeper insights.

Vertical Analysis: Seeing Proportions

Vertical analysis expresses each line item on your P&L as a percentage of your total revenue. This helps you understand the proportional contribution of each expense to your bottom line.

- Example: If your rent is $1,000 and your total revenue is $10,000, your rent represents 10% of your revenue. If your software subscriptions are $200, that's 2% of revenue.

- Why it's useful: It quickly shows you where the majority of your revenue is going. If your "Marketing" expense jumps from 5% to 15% of revenue in one quarter, you'd want to investigate if that spend is yielding a proportional increase in clients.

Horizontal Analysis: Tracking Changes Over Time

Horizontal analysis involves comparing financial data across multiple reporting periods (e.g., comparing Q1 2023 to Q1 2024). This method tracks changes over time, helping you identify growth patterns, trends, and anomalies.

- Example: Your revenue grew by 15% from last year, but your operating expenses grew by 25%. This "horizontal" view immediately flags an issue: your costs are rising faster than your income, impacting your profitability.

- Why it's useful: It provides a dynamic view of your practice's financial trajectory, making it easier to spot emerging problems or celebrate successful growth initiatives.

Key Financial Ratios to Watch

A few simple ratios can give you powerful insights at a glance:

- Gross Profit Margin: This tells you how efficiently your practice generates profit from its core services before accounting for operating expenses.

- Formula: (Gross Profit ÷ Net Revenue) × 100

- Example: If your gross profit is $8,000 and net revenue is $10,000, your gross profit margin is 80%. A high margin is generally good for a service business.

- Net Profit Margin: This is the ultimate indicator of your practice's overall profitability. It shows how much of each revenue dollar converts into actual profit after all expenses are accounted for.

- Formula: (Net Profit ÷ Net Revenue) × 100

- Example: If your net profit is $3,000 and net revenue is $10,000, your net profit margin is 30%. This helps you benchmark your practice's efficiency.

Monitoring these KPIs monthly, and investigating any significant shifts (e.g., a drop in gross profit margin from 75% to 65%), allows you to take corrective actions before small issues become big problems.

Frequently Asked Questions About SimplePractice P&Ls

Q: Does SimplePractice categorize all my expenses automatically?

A: SimplePractice automatically tracks your income from client payments and insurance. For expenses, you typically need to record them yourself, either by manually entering them into SimplePractice's expense tracking feature (if you use it) or by reconciling them in a separate accounting software linked to your bank. SimplePractice's P&L will then pull from these recorded expenses.

Q: Can I customize the categories on my SimplePractice P&L?

A: SimplePractice offers standard expense categories. While you might have some flexibility in how you label items when recording expenses, the main report structure uses predefined categories for consistency. For highly customized reporting, exporting to Excel and manipulating the data might be necessary.

Q: How often should I generate my P&L report?

A: For most private practices, monthly is ideal. This allows you to catch issues early and make timely adjustments. Quarterly reports are good for trend evaluation and planning, while annual reports are essential for tax preparation and high-level strategy.

Q: What if my P&L shows a net loss?

A: Don't panic, but investigate immediately. A net loss means your expenses exceeded your income for the period. Analyze which expenses were high and if revenue was unexpectedly low. This could be due to one-time large purchases, a slow month, or an unsustainable expense structure. Consult with an accountant for guidance.

Q: Is the SimplePractice P&L sufficient for tax purposes?

A: For many solo practitioners, the SimplePractice P&L (combined with other financial records) can be a strong foundation for tax preparation. However, it's always recommended to share all your financial reports with a qualified tax professional or accountant, as they can ensure all deductions are captured and reconcile with other financial statements.

Your Practice, Your Profit: The Power of the P&L

The Profit & Loss Report isn't just a compliance document; it's a dynamic tool that empowers you to make informed decisions and steer your private practice towards greater financial health and sustainability. By consistently generating, reviewing, and acting upon the insights from your SimplePractice P&L, you transform from a reactive practitioner to a proactive business owner, confidently building the practice you envision. Start making your P&L work for you today, and unlock the full potential of your hard work.